kentucky transfer tax calculator

In those areas the state transfer tax rate would be 300. In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median.

Income Tax Calculator 2021 2022 Estimate Return Refund

3 a If any deed evidencing a transfer of title subject to the tax herein imposed is.

. The tax required to be levied by this section shall be collected only once on each transaction and in the county in which the property. Kentucky Income Tax Calculator 2021. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Actual amounts are subject to change based on tax rate changes. 25000 income Single with no children - tax 1136 35000 income Single parent with one child - tax 1676 50000 income Married with one child - tax 2526 60000 income Single parent with one child - tax 3126 80000 income Married with two children - tax 3251. Kentucky Property Tax Rules.

Your household income location filing status and number of personal exemptions. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Mercer County Tax. Overview of Kentucky Taxes.

1 of each year. Real estate in Kentucky is typically assessed through a mass appraisal. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Some areas do not have a county or local transfer tax rate. Motor Vehicle Usage Tax Section. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

For comparison the median home value in Kenton County is 14520000. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

The State of Delaware transfer tax rate is 250. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Kenton County Tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

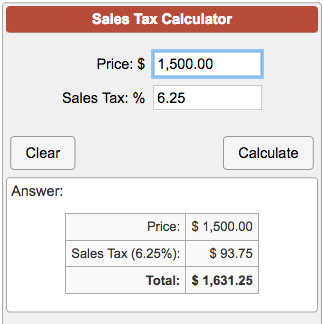

The tax is computed at the rate of 50 for each 500 of value or fraction thereof. You trade in a vehicle for 5000 and get an incentive for 2000. Please note that this is an estimated amount.

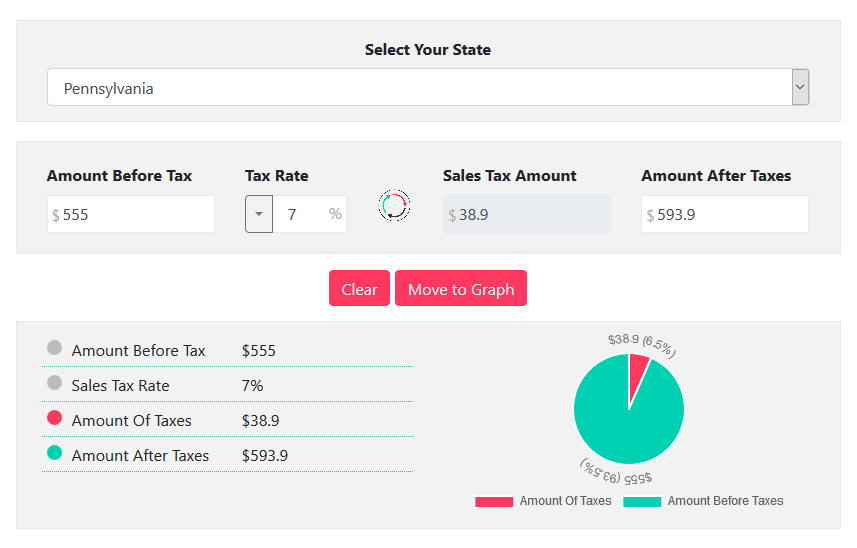

For Kentucky it will always be at 6. Delaware DE Transfer Tax. Your average tax rate is 1198 and your marginal tax rate is 22.

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. 2 A tax upon the grantor named in the deed shall be imposed at the rate of fifty cents 050 for each 500 of value or fraction thereof which value is declared in the deed upon the privilege of transferring title to real property. A deed cannot be recorded unless the real estate transfer tax has been collected.

Important note on the salary paycheck calculator. Of course where you choose to live in Kentucky has an impact on your taxes. Kentucky Alcohol Tax.

The calculator on this page is provided through the ADP. Select an Income Estimate. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Email Send us a message. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

For comparison the median home value in Mercer County is 12940000. Please contact them at 502 564-5301 or. Kentucky Department of Revenue.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083. Kentucky imposes a flat income tax of 5. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

Download Or Email Form 740-ES More Fillable Forms Register and Subscribe Now. The Kentucky Transportation Cabinet is responsible for all title and watercraft related issues. All rates are per 100.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

The tax rate is the same no matter what filing status you use. The transfer tax is imposed upon the grantor. For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 6.

Kansas does charge tax on trade-ins but not on rebates. The tax estimator above only includes a single 75 service fee.

Dmv Fees By State Usa Manual Car Registration Calculator

Kentucky Property Tax Calculator Smartasset

Pennsylvania Sales Tax Calculator Reverse Sales Dremployee

Transfer Tax In San Luis Obispo County California Who Pays What

Cryptocurrency Taxes What To Know For 2021 Money

Transfer Tax In San Diego County California Who Pays What

What You Should Know About Contra Costa County Transfer Tax

Calculate Sales Tax On Car Outlet 60 Off Www Ingeniovirtual Com

Transfer Tax Alameda County California Who Pays What

Calculate Sales Tax On Car Outlet 60 Off Www Ingeniovirtual Com

What Is Sales Tax Nexus Learn All About Nexus

Transfer Tax Calculator 2022 For All 50 States

Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan Mortgage Loans Mortgage Lenders Usda Loan

Property Tax How To Calculate Local Considerations

Sales Tax Calculator Credit Karma

A Breakdown Of Transfer Tax In Real Estate Upnest

Buying A Home Isn T Just A 20 Down Payment And A Monthly Check For The Mortgage Here Are 9 Hidden Co Buying First Home Home Buying Checklist First Home Buyer